Comprehending Assurance Services: The Relevance of Comprehensive Audit Solutions for Your Company

Thorough audit solutions encompass various types, each created to enhance openness and liability while mitigating potential risks. By checking out how these audits can determine ineffectiveness and ensure conformity, organizations can position themselves for growth and boosted stakeholder depend on.

What Are Assurance Providers?

Assurance services are an important component of the organization landscape, offering stakeholders with self-confidence in the accuracy and reliability of monetary information. These services are developed to improve the reputation of information provided by a company, assisting in notified decision-making by investors, regulatory authorities, and other interested celebrations. Guarantee solutions include a series of tasks, including audits, testimonials, and collections, each varying in the degree of assurance they offer.

The main purpose of assurance solutions is to evaluate and verify the honesty of financial statements and records. By using qualified specialists, such as state-licensed accountants (CPAs), companies can make sure that their monetary information sticks to established requirements and policies. This process not just advertises transparency but likewise assists in determining areas for renovation, decreasing the risk of scams and financial misstatement.

>br/>

Kinds Of Audit Services

Audit services stand for a particular category within the more comprehensive structure of guarantee solutions, focusing mainly on the assessment of monetary declarations and relevant procedures. There are numerous kinds of audit solutions, each designed to satisfy different requirements and conformity demands.

One of the most typical type is the outside audit, performed by independent auditors to supply an objective assessment of a firm's financial statements. This audit intends to make certain precision and adherence to normally approved accountancy concepts (GAAP) or International Financial Reporting Criteria (IFRS)

An additional kind is the compliance audit, which evaluates whether a company sticks to certain laws, regulations, or internal policies. This can be specifically crucial for industries with stringent regulative requirements.

Lastly, there go to the website are forensic audits, intended at examining discrepancies or scams within economic documents. Each kind of audit service plays a crucial role in making certain transparency, liability, and rely on financial coverage, adding considerably to the overall wellness of a service.

Benefits of Extensive Audits

Comprehensive audits supply invaluable understandings that enhance organizational integrity and operational efficiency - CPA audit firm. By systematically assessing monetary documents, conformity with laws, and internal controls, these audits determine potential disparities and locations for improvement. This detailed evaluation not only safeguards assets but additionally fosters a society of liability within the company

One of the main benefits of detailed audits is the identification of inadequacies in processes, which can result in cost financial savings and boosted efficiency. Organizations can enhance procedures and allot sources extra properly, leading to improved overall efficiency. Additionally, the transparency offered by these audits develops trust fund with stakeholders, consisting of capitalists, clients, and regulative bodies.

Furthermore, comprehensive audits add to better decision-making by providing management with exact and appropriate information. This assists in tactical preparation and risk assessment, enabling companies to adjust to market modifications confidently. Normal audits help make certain compliance with lawful and governing requirements, reducing the risk of description charges and reputational damages.

The Function of Threat Monitoring

Effective risk administration is a cornerstone of organizational strength, enabling services to navigate uncertainties and profit from opportunities. In today's dynamic setting, business encounter a myriad of threats consisting of operational, economic, regulatory, and reputational hazards. A durable danger monitoring structure assists companies determine, evaluate, and mitigate these dangers, ensuring they can receive procedures and achieve strategic objectives.

Integrating risk administration right into decision-making processes improves service dexterity (Assurance Services). By comprehending potential difficulties, companies can allocate resources extra effectively, prioritize initiatives, and carry out positive actions. This insight not just minimizes potential losses but likewise cultivates a culture of liability and openness

Additionally, reliable danger administration sustains conformity with regulative needs, protecting companies versus legal consequences. It likewise straight from the source boosts stakeholder depend on, as capitalists and consumers are more probable to involve with companies that show a commitment to managing unpredictabilities.

Picking the Right Service Provider

Picking an ideal company is important for companies looking for guarantee services that line up with their specific requirements and purposes. The procedure begins with recognizing the particular solutions needed, whether they be internal audits, conformity evaluations, or risk monitoring examinations. A complete understanding of your company's distinct obstacles and governing setting will guide this choice.

Following, assess possible companies based upon their certifications and proficiency. Search for firms with pertinent market experience, a solid performance history, and certifications such as CPA or CIA. In addition, examine their reputation with client testimonies and study to evaluate their effectiveness and dependability.

Communication is one more crucial factor; the selected supplier should show openness and a joint technique. Consider their ability to share intricate searchings for in an understandable way, as this will certainly promote enlightened decision-making.

>br/>

Verdict

In conclusion, thorough audit solutions are necessary for enhancing the reliability of financial information within organizations. By efficiently mitigating risks, durable audits equip services to make informed decisions and boost functional performance.

Mike Vitar Then & Now!

Mike Vitar Then & Now! Gia Lopez Then & Now!

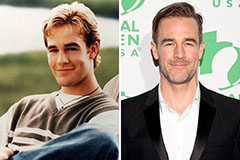

Gia Lopez Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!